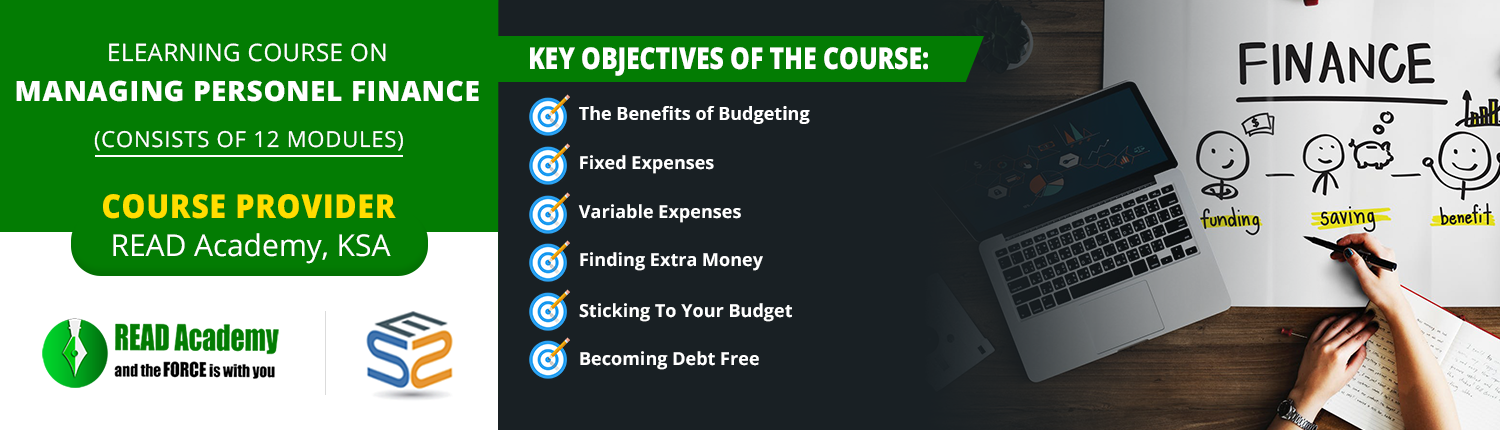

Managing Personel Finance and Money Planning Online Course

Simply quoted “A penny saved is a penny earned” remains simply uncomprehending as there are millions struggling with debt. For most of us, personal finances are a mystery, filled with shame and anxiety. Many have a hard time in creating budget and sticking to it. But with just a little encouragement, and the right tool, anyone can master the art of personal finance.

It all begins with debt; a lot of debt can be alleviated if you have the right tool. This workshop will provide you with the tools you need to reduce or eliminate debt, and give you the financial stability you need. The guide teaches you the benefits of having a budget and how to build a budget that fits your needs, and lifestyle. You will discover how you can cut costs, pay off debts, and live within your budget. Personal finance is a road map to help you reach your financial goals.

Here’s a overview of what is covered in this wonderful new course:

- The Benefits of Budgeting: learn to plan spending, lower debt and build savings – while reducing stress and family conflicts

- Fixed Expenses: these expenses include items like utilities, rent, and transportation, as well as payments on debt

- Variable Expenses: discretionary expenses will include entertainment and dining out, costs that can really add up if you aren’t paying attention

- Financial Goals: you’ll need to establish your financial goals for both the near future and in the long term

- Reduce Spending: next prioritize your expenses versus your financial goals to help you plan where the money should go each month

- Financial Planning Tools: there are many tools to help you better manage your finances, including the “cash envelope system”

- Sticking To Your Budget: explore some of the many ways to help you stay accountable to your budget so that you can reach your financial goals

- Finding Extra Money: this section brainstorms additional ways to make a little extra money such as selling unused items, part-time jobs, and self-employment opportunities

- Becoming Debt Free: start with the small stuff, and work your way up: you’ll build confidence with the little wins until it becomes a habit

- Building Wealth: most people become debt free within a few years, then focus on retirement goals and building wealth!

We’d like to see every workplace offer Personal Finance Management training. As employees become more financially secure, and employers become more profitable, everyone has the ability to help make the world a better place.

| 12 Modules | Objective | Certificate |

| Follow the suggested order or choose your own. | Designed to help you practice and apply the skills you learn. | Highlight your new skills on your resume or LinkedIn. |

Module One: Getting Started

- Icebreaker

- Housekeeping Items

- The Parking Lot

- Workshop Objectives

Module Two: The Benefits of Budgeting

- Getting Rid of Debt

- Generating Savings

- Reducing Stress and Anxiety

- Lessening Family Conflicts

- Case Study

- Review Questions

Module Three: What to Consider Before Creating a Budget

- Understand Your Income

- Determine a Budget Duration

- Determine Expenses

- Track What’s Being Spent

- Case Study

- Review Questions

Module Four: Types of Fixed Personal Expenses

- Utility Bills

- Housing Bills

- Transportation

- Debt Payments

- Case Study

- Review Questions

Module Five: Types of Fluctuating Personal Expenses

- Personal Care

- Entertainment

- Eating Out

- Case Study

- Review Questions

Module Six: Establish Your Goals

- Short Term vs Long Term

- Be Realistic

- Actually Get Rid of Debt

- Save for the Future

- Case Study

- Review Questions

Module Seven: Determine Where Cuts Can Be Made

- Cut Bad Habits

- Decrease Transportation Costs

- Reduce Utility Bills

- Decrease Entertainment Expenses

- Case Study

- Review Questions

Module Eight: Tools

- Software

- Phone Applications

- The Envelope System

- Expenditure Notebook

- Case Study

- Review Questions

Module Nine: Stick With Your Budget

- Use Cash for Weekly Allowance

- Accountability to Family or Friends

- Set Up a Different Account for Savings

- Remind Self of Benefit to Sticking with Budget

- Case Study

- Review Questions

Module Ten: Additional Ways to Make Money

- Make and Sell Items

- Sell Unused Items

- Small Part-Time Job

- Recycle for Money

- Case Study

- Review Questions

Module Eleven: Paying Off Debt

- Get Three Credit Reports

- Start with Small Stuff and Work Your Way Up

- Credit Card Hacks

- Investigate Student Loan Repayment or Consolidation Options

- Case Study

- Review Questions

Module Twelve: Wrapping Up

- Words from the Wise

- Review of Parking Lot

- Lessons Learned

- Completion of Action Plans and Evaluations

All of these professional training resources are based on the most up-to-date body of knowledge and carefully selected by subject matter experts.

We are just a step away to fulfill your eLearning requirements. For any requirements on course-ware development please contact us at [email protected].

Our Services: Rapid eLearning, Custom eLearning Solutions, Flash to HTML5 Conversion

Leave a Reply

Want to join the discussion?Feel free to contribute!